4 min read

Fleet Safety Best Practices: 6 Steps to Get Results

Fleet safety is a top priority for enterprise organizations in today's fast-paced business environment....

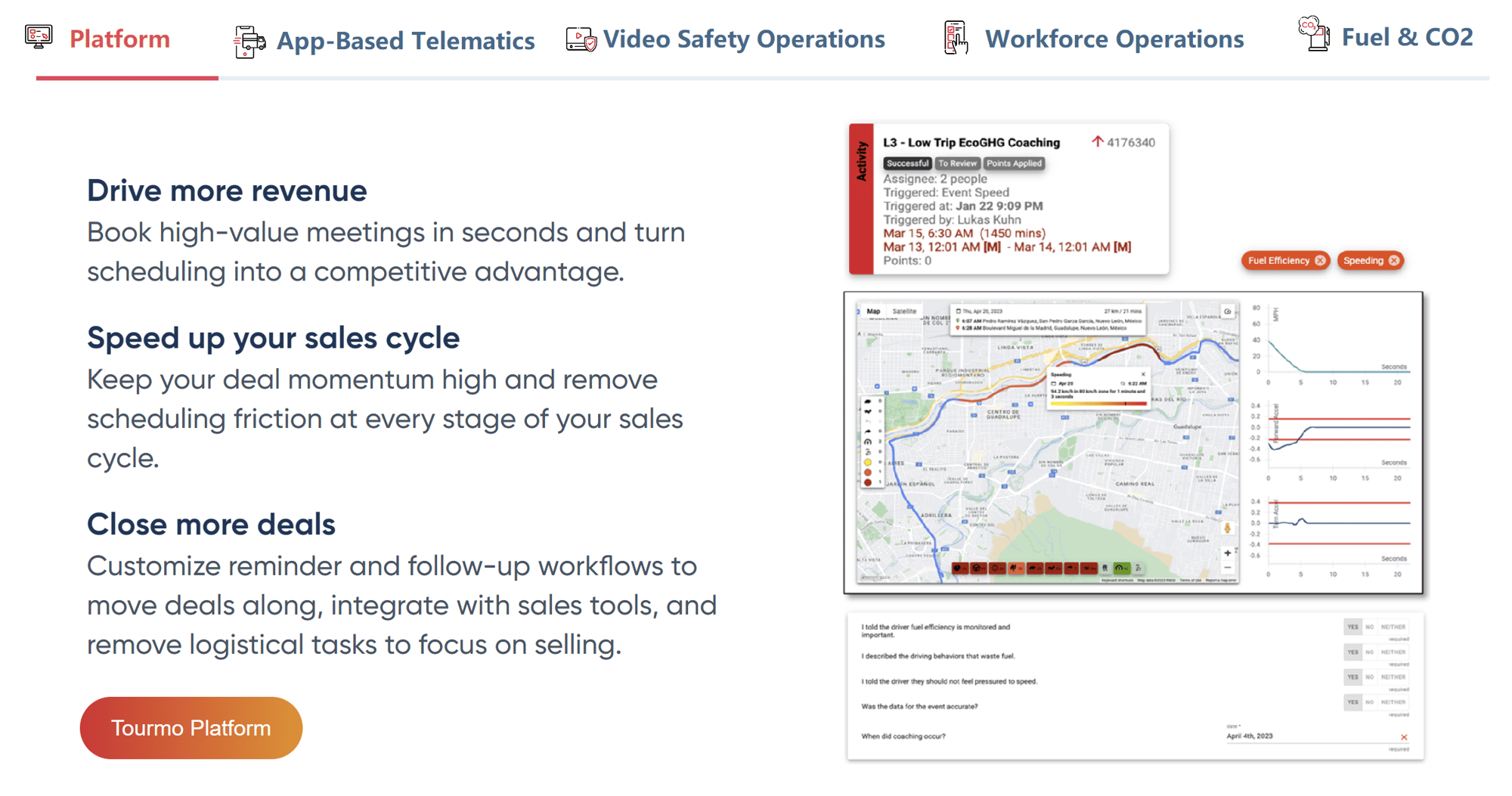

Integrate external data sources into the Tourmo platform.

Analyze data on acceleration, braking, speed, & location.

Fuel transaction reconciliation & suspicious fuel events.

AI video, in-cab driver guidance, automated workflow, & analytics.

Decision guidance, digitization, & automated communication.

Capture, aggregate, and normalize your fleet data from infinite disparate sources and point solutions - no rip and replace.

Use artificial intelligence and machine learning to automate contextualized business intelligence - all in real time.

Provide daily prioritized actionable tasks to all levels of your organization – improve accountability, engagement, and operational performance.

Video Systems

Telematics

ELD / MVR / HOS

Fuel System

Dispatch/Resource Management

Maintenance

ERP / CRM

Tourmo centralizes your existing telematics, video, fuel, maintenance, and other fleet-related data to prioritize tasks for your managers and drivers to achieve more with less.

Don't rip and replace existing hardware or software

Tourmo offers a modern mobile phone/tablet application and AI video dash cams for organizations without legacy telematics hardware.

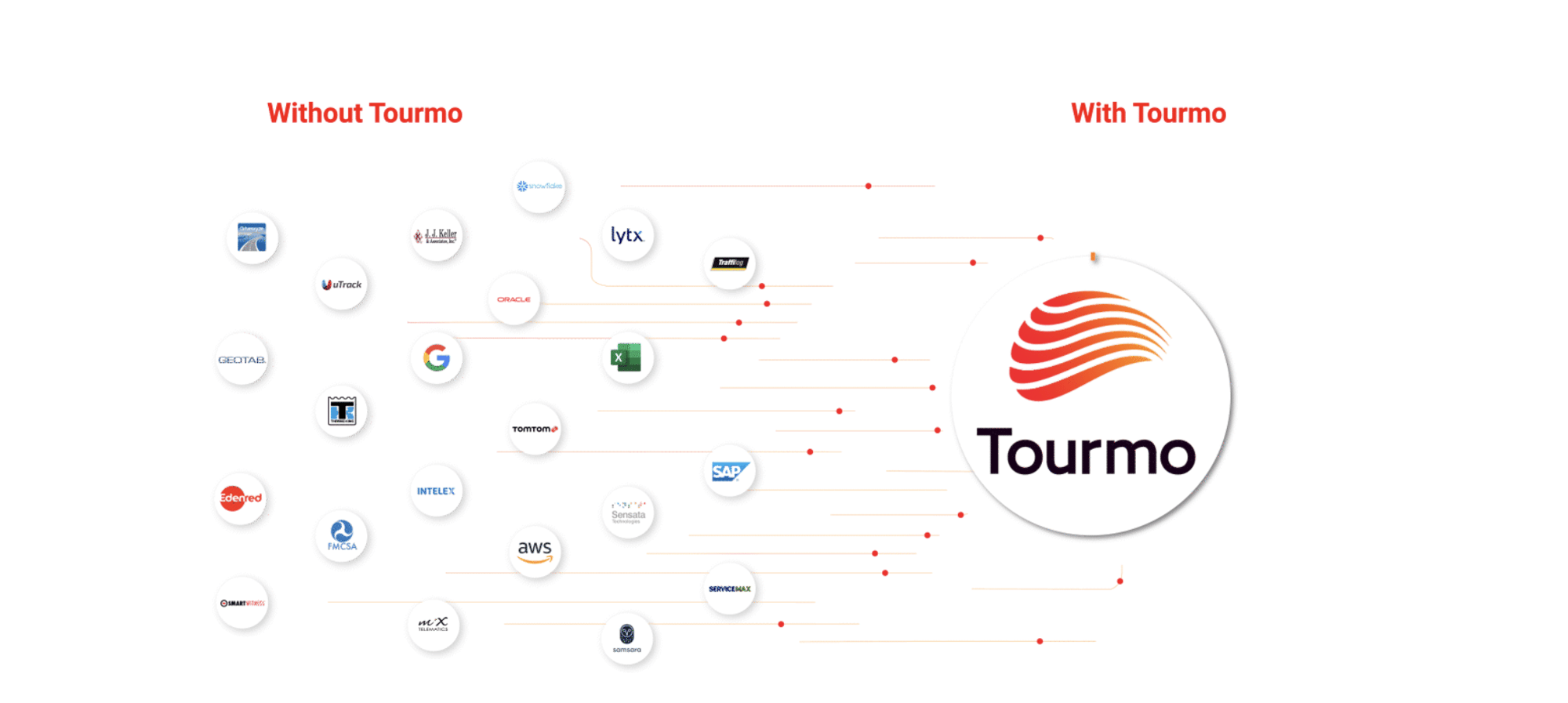

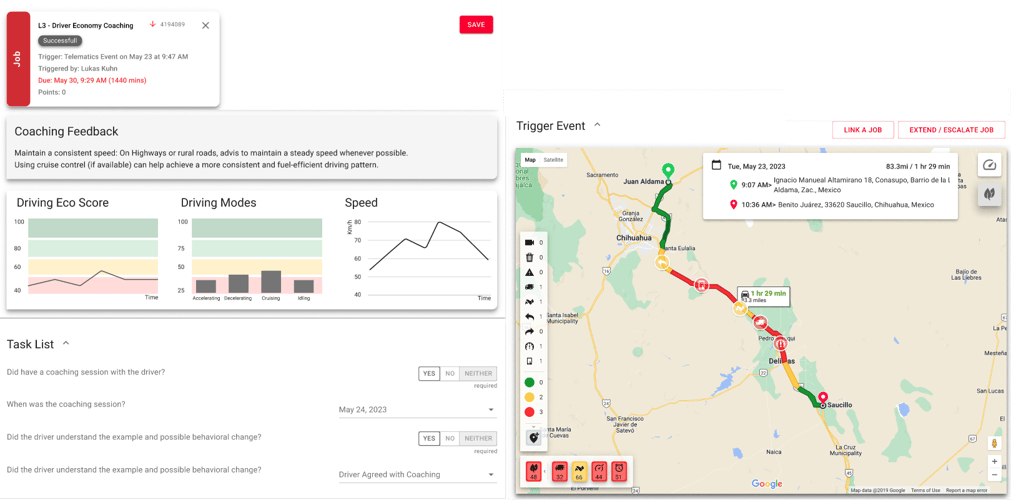

Encourage safe driving behavior and reduced fuel consumptionTourmo® AutoPilot gets the right information to the right person at the right time. AutoPilot uses high priority alerts, follow-up actions, and automated coaching for drivers and managers to significantly increase outcomes.

.png?width=1240&height=813&name=System%20Driven%20Task%20Management%20(1).png)

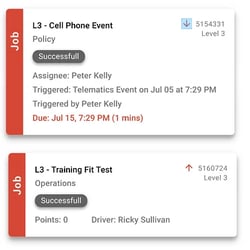

Implement system-driven task management and workflows to automate day-to-day tasks for drivers and managers. With digital task assignments, reminders, and real-time updates, employees can focus on core responsibilities.

Streamline operations by consolidating data from diverse sources and applying smart data aggregation to create daily jobs allowing managers to significantly increase engagment in their limited available time.

.png?width=1240&height=813&name=Automated%20Driver%20Management%20(2).png)

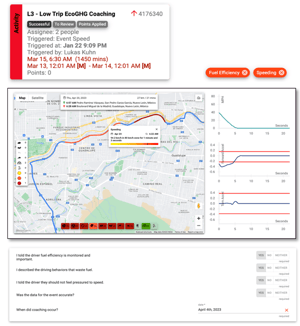

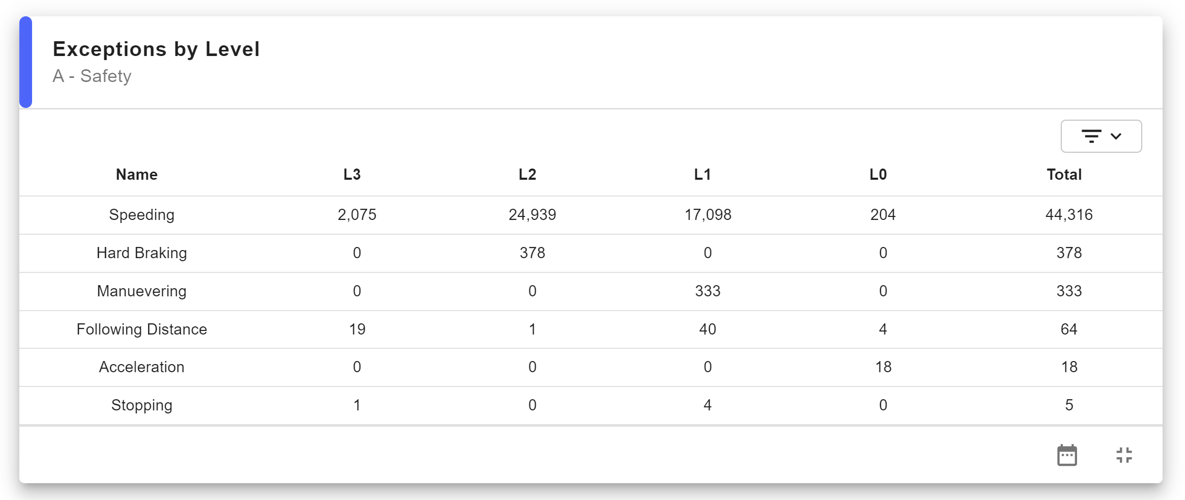

Increase company policy compliance effectiveness through system-driven performance and violation exceptions. Follow-up actions equip drivers with the information needed for self-coaching and remediation.

.png?width=1240&height=813&name=AI%20Assistant%20(1).png)

Tourmo® CoPilot turns any questions you have about your fleet into insightful data presentations. Research through natural language via a text prompt any data you have for 1-time reports or use the search to permanently add dashboards.

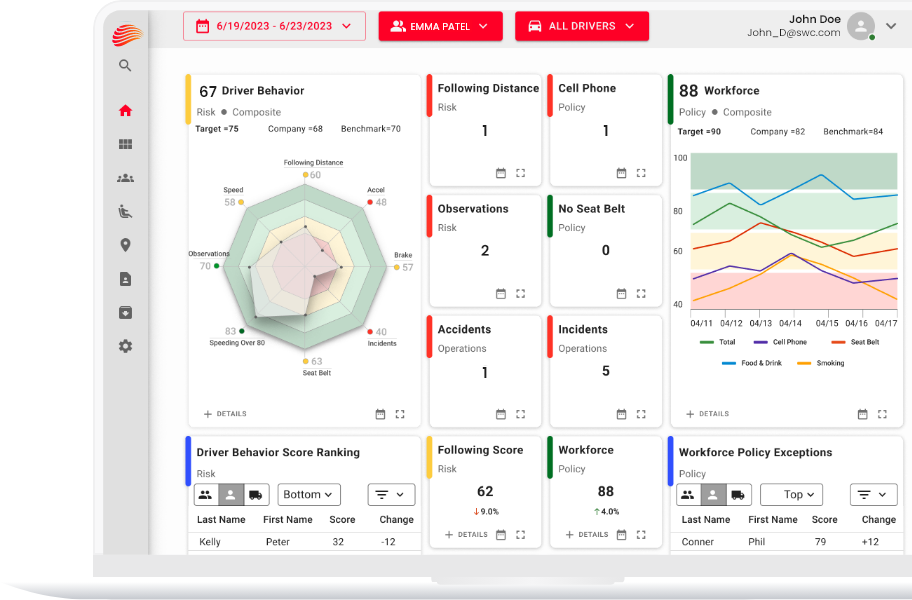

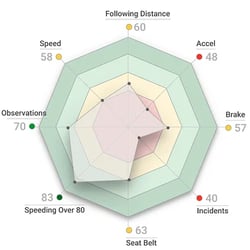

.png?width=1240&height=813&name=Configurable%20Dashboards%20(1).png)

Increase effectiveness of management with a central customized dashboard to manage severe events, KPIs, tasks, and workflows, while our rules engine handles daily communication with drivers.

Optimize Profit

Our patented mobile workforce management software provides contextualized business intellegence and generates actionable insights in real time. The automated workflows can result in saving millions of dollars annually.

Streamline driver task management through system-driven exceptions with follow-up actions, equipping drivers with the information needed for self-coaching.

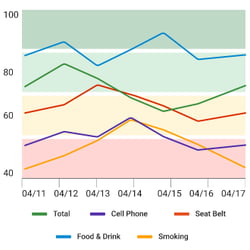

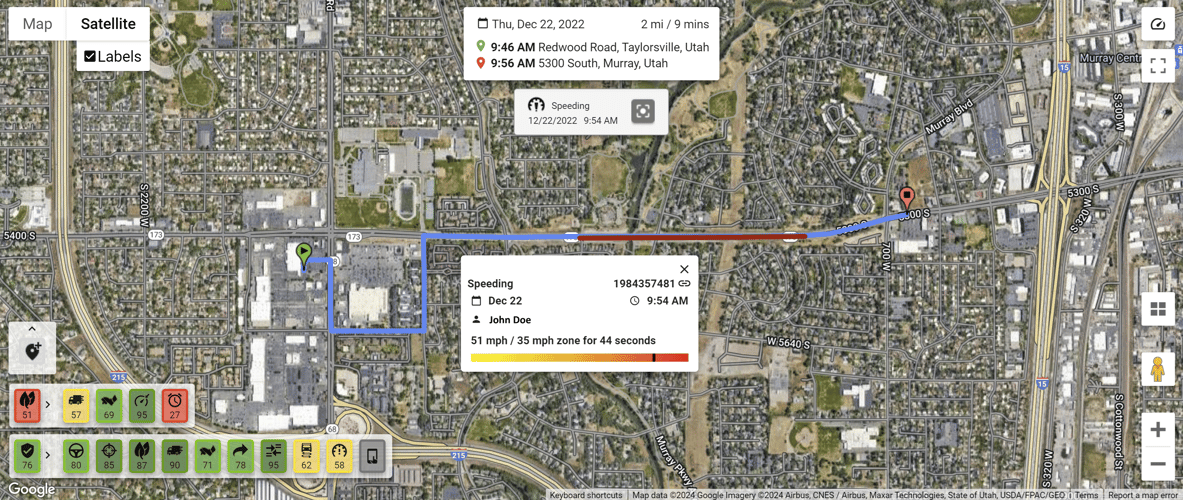

Patented context-aware AI considers weather, road type, elevation, speed limit, location, history, and much more for total objectivity.

Driver scorecards and ranking include feedback, positive reinforcement, and gamification for improved driver safety outcomes.

Automate your fleet's carbon footprint monitoring, coaching, and regulatory reporting (including GHG Protocol-Compliant Reporting).

Match fuel transactions and pinpoint suspicious activities, ghost transactions, fuel level drops, and missing purchase analysis and alerts.

The Tourmo platform processes data from any mobile or telematics device for context-aware driving analytics. Using a targeted scoring system, driver coaching, and gamification, Tourmo increases fleet fuel efficiency.

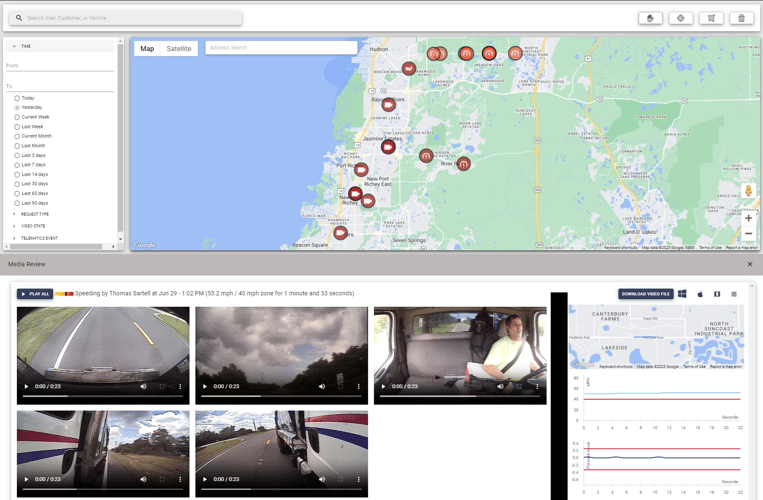

Instead of costly replacements, Tourmo will enhance your existing camera systems with time-saving software solutions to reduce false positives, contextualize events, and quickly find specific video footage.

Tourmo will fetch critical video segments, streamlining them into automated workflows, ensuring managers aren't overwhelmed with tasks such as service verification requests and exceptions.

Access dashboards with fleet video analytics and crucial metrics with alerts for significant trends or deviations.

Real-time analysis of your plan versus actual with automatic notification of route deviation, unplanned stops, delays at client or plant site, and more.

Configurable templates, tasks, and workflows allowing your organization to digitize and automate your unique manual processes, providing automatically escalation and visibility to all internal and external stakeholders.

Gather and maintain all of the required records for your mobile workforce (e.g. driver license, training, certifications) to verify that a worker is fit for duty. Automate the entire process from requesting, submission, updating, and all related communications.

Aggregate, unify, normalize and correlate your data from infinite disparate sources and point solutions – no rip and replace.

Use AI and Machine Learning to automate contextualized business intelligence - all in real time.

Create effective, efficient, AI-driven workflows - gain dramatic improvements in cost, and employee, customer and partner experience.

National auto parts retailer improved safety and lowered costs.

Countrywide food service distributor saved $1.2M by eliminating fuel theft.

California DMV digitally modernized and transformed their field operations .

International Public Transport Operator Is Transforming Employee Safety and Operational Efficiencies.

Fleet safety is a top priority for enterprise organizations in today's fast-paced business environment....

Putting a commercial driver safety program in place is critical to ensure the safety of mobile workers and...

Despite the prevalence of a safety-first policy in fleet management, many businesses need help implementing...

Users on the Tourmo platform

Tasks tracked and completed

Miles processed through AI

Safety events recorded

Product Demonstration